Examine This Report on Lamina Loans

Table of ContentsWhat Does Lamina Loans Mean?Lamina Loans Can Be Fun For AnyoneThe Best Guide To Lamina LoansThe Best Guide To Lamina LoansSome Of Lamina LoansThe 8-Minute Rule for Lamina LoansWhat Does Lamina Loans Mean?

Working to improve your credit rating is a terrific action to take previously getting an individual financing. Real, even if your credit score health and wellness is reduced, there are subprime lending institutions out there that can approve you the personal car loan you need. However, as we claimed, your rates of interest can wind up being extremely high, costing you hundreds, also thousands of bucks added.

If you're looking for a low-interest individual loan in Canada, there are a couple of things you can do to get one. Car loan interest loans can be obtained by doing one or more of the following: As formerly discussed, security reduces the loan providers' borrowing danger. As such, they are a lot more ready to provide a low-interest lending when you use an asset as collateral.

The Ultimate Guide To Lamina Loans

Like collateral, this gives your lender with additional safety and security. You can get a low-interest car loan in Canada, if you obtain a cosigner for your finance. Your credit report rating can greatly impact the rates of interest you jump on your loan. The higher your credit report, the much more likely you'll get approved for a low-interest funding in Canada.

It's called a "guarantor finance" and includes discovering a cosigner prior to applying. Your very own poor credit report will no more be a concern throughout the application procedure. Instead, your authorization will hinge on your cosigner's credit rating wellness. Preferably, your cosigner would certainly require to have great credit report and a suitable earnings - Lamina Loans.

Yes, there are many different lenders in Canada that supply personal fundings without credit rating checks. In place of your credit history, they will certainly assess your revenue level, work stability, debt-to-income proportion and also various other monetary aspects that will certainly determine your credit reliability. When requesting an individual funding you'll need to offer particular paperwork for verification and identification purposes.

Not known Facts About Lamina Loans

The rate you're billed depends on your lending institution, your credit history rating, your debt-to-income proportion, as well as even your lending terms. On standard, rate of interest rates differ anywhere between 15% and 45% for an individual car loan.

Click the button listed below to complete an application to see what your options are.

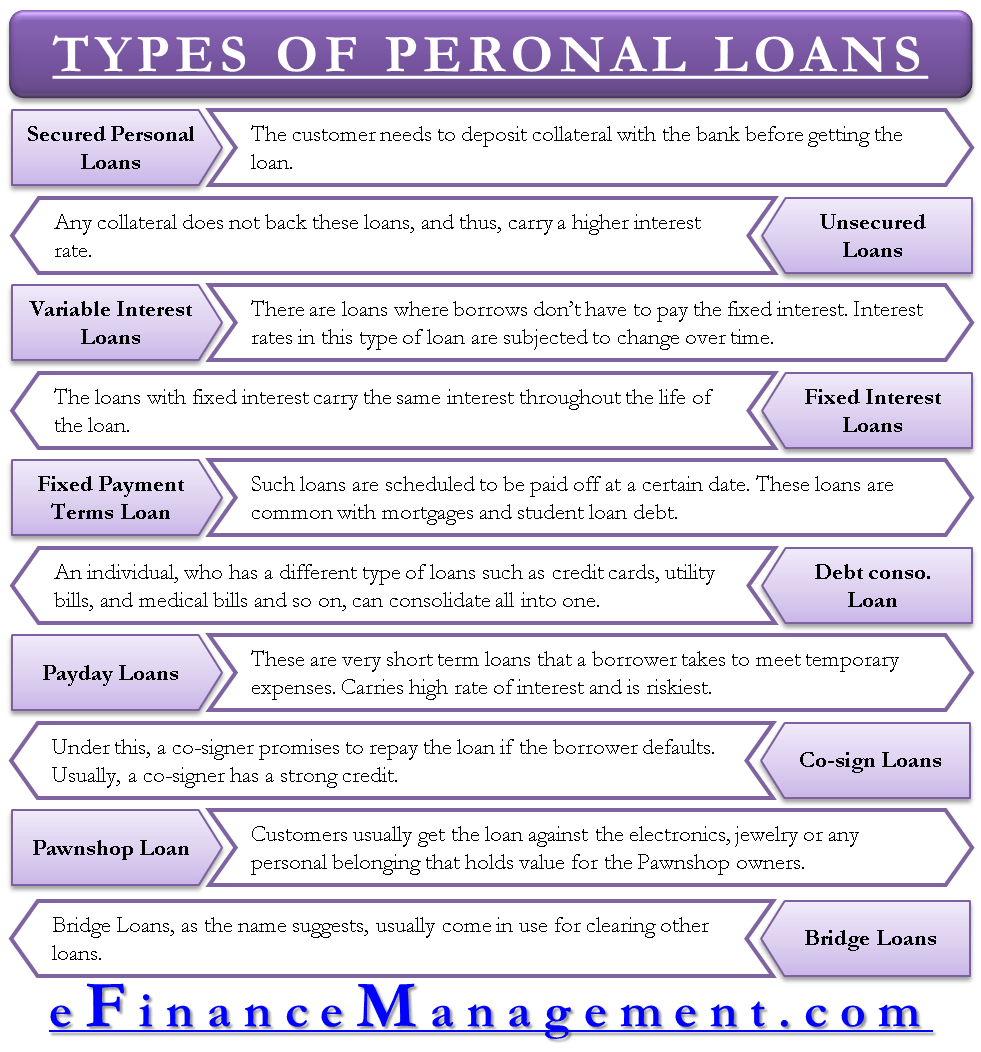

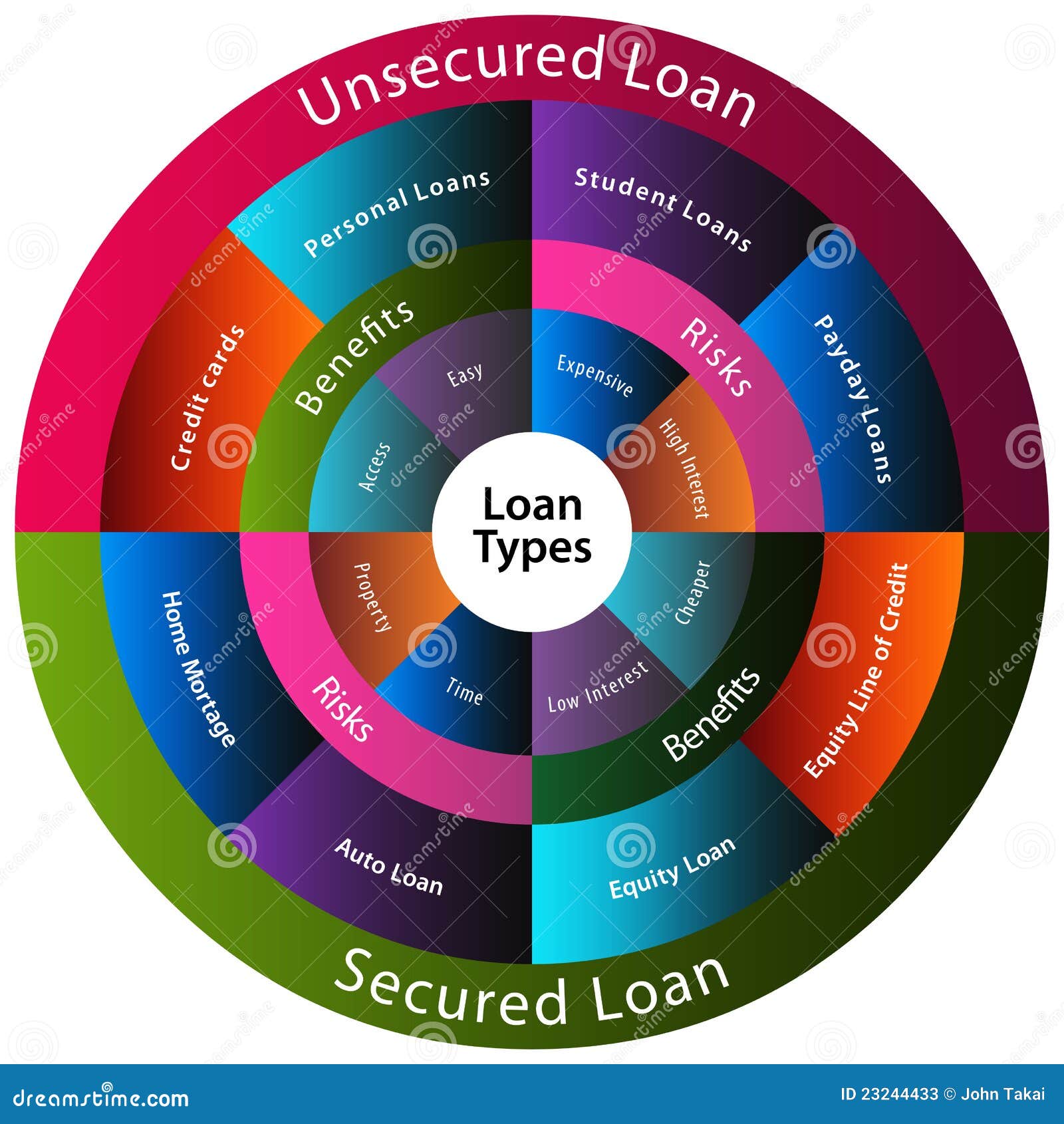

To help you determine, right here are the advantages and disadvantages of all the different kinds of car loans: Most personal loans as well as bank loan are unsafe lendings. Unsecured means that you're obtaining money without placing anything up as collateral to "secure" the car loan. These fundings normally need a higher credit history to prove your creditworthiness.

Lamina Loans Things To Know Before You Buy

Some loan providers might even enable you to establish an affordable repayment amount based upon your earnings as well as rate of interest. Compare personal loan lenders prior to you make a choice, so you can find the best terms for your circumstance. You can usually secure a personal lending for whatever try this site you require it for like residence renovation or financial obligation combination.

The lower your rating, the less most likely you are to certify and also if you do, the higher your rates of interest will certainly be. You'll need to confirm you can manage to pay the lending back. If you do not have a consistent task with a reliable earnings, you might not obtain approved for a funding.

Lamina Loans - Questions

It's best for any person with an excellent credit scores rating who can prove they'll pay it back on visit this site right here a monthly basis. Protected personal finances are loans that need collateral like your house or vehicle to "secure" or get the loan. If you skip on your loan, the loan provider can confiscate the residential property you put up as collateral.

Due to the fact that you're making use of something as security, protected finances are simpler to get for individuals with lower credit report. Considering that there's collateral, the lender sights you as a less dangerous consumer, so passion rates have a tendency to be lower on protected fundings If you don't make on-time repayments, your collateral can get eliminated.

A protected financing is wonderful for someone who does not have a perfect credit rating for a finance yet requires one anyhow. If you don't have a high credit rating score, think about a protected financing to prove you can pay in a timely manner every month. A rotating credit line gives you accessibility to cash that you can borrow up to your credit history limitation.

The Ultimate Guide To Lamina Loans

If you lug a balance, you probably will need to pay rate of interest on top of that amount - Lamina Loans. Rotating credit report comes in the type of charge card, a personal line of credit, or a house equity line of credit rating (HELOC). If you have actually obtained expenses that schedule, but don't earn money for a few weeks, rotating credit score can help you pay those expenses.

Many credit rating cards offer rewards for use, like cash back, points, or other benefits. What you owe on a monthly basis depends on what you obtain. This quantity can rise and fall based upon just how you use your rotating credit scores. Revolving debt, specifically charge card, often tend to have the highest possible visit this page rates of interest. So make sure you can pay off your balance completely every month or you'll be stuck paying great deals of money in interest.

If you have terrific credit report, you can receive a reduced rate of interest rate in instance you do bring a balance over from month to month. Installment fundings are fundings that have a specific quantity of payments and also when you pay them back, your car loan is paid in full. This is the reverse of rotating credit report, where you can take money out and pay it back throughout a few months or years, relying on your contract.

The smart Trick of Lamina Loans That Nobody is Talking About

If your installment car loan has a set rate of interest, your loan payment will certainly be the very same monthly. Your spending plan won't rise and also fall based on your repayments, which is handy if you don't have a lot of wiggle area for variation. Installment financings do not allow you to go back as well as secure extra in instance you need it.

Otherwise, you may need to get one more financing. Having a set amount you need to borrow and also pay back makes installment lendings ideal for somebody that knows precisely just how much they need as well as just how much they can afford. A fixed rates of interest is a rate that does not alter over the life of the loan.